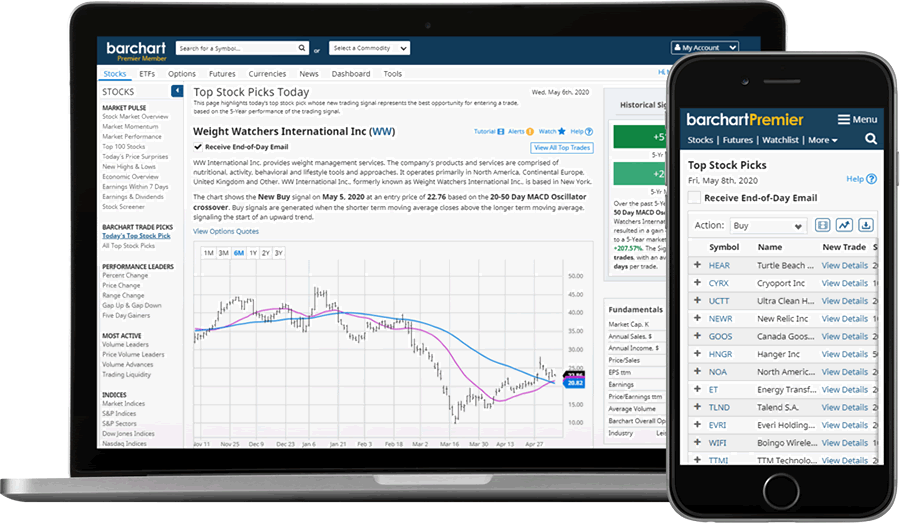

Today's Top Stock Pick showcases the top stock found by Barchart's Opinions. Available only with a Premier Membership, the top stock pick is the one that generated a new trading signal at the end-of-day which represents the best opportunity for entering a trade based on the 5-Year performance of the trading signal. The Top Stock Pick is presented as a trading idea for a stock that is entering a new position that you may want to watch.

The Top Stock Pick must meet the following requirements:

- It has the highest 5-Year Signal Gain and is the first symbol listed on the All Top Stock Picks page.

- The Win% for the specific trading strategy/signal must be greater than 30%. This highlights only trades that historically have had a greater chance of a profitable signal exit.

- The 20-Day Historical Volatility for the symbol must be less than 100%. This filter is applied to eliminate stocks that have short-term price spikes.

- The symbol's last price must be greater than $2.00.

- The 20-day average volume must be greater than 10,000.

To understand the Top Stock Picks, you must first understand the concept behind the Barchart Opinion and the Trading Strategies. Barchart Opinions show traders what a variety of popular trading strategies are suggesting in terms of going long or short the market. The Opinions takes up to 5 years' worth of each symbol's historical data and runs the prices through thirteen different technical indicators. After each calculation, Opinion assigns a buy, sell or hold value for each study, depending on where the price lies in reference to the common interpretation of the study.

For example, if the end-of-day price for a stock is above the 50-Day Moving Average, the general interpretation of this trading strategy is that the stock in in an upward trend or a "buy". The stock's 50-Day Moving Average Opinion, then, will generate a "Buy" signal. All Opinions for a symbol can be found on the Barchart Opinion page.

The thirteen technical indicators used by the Top Picks include short, medium, and long-term strategies:

- Short Term: 20-Day Moving Average, 20-50 Day MACD, 20-100 Day MACD, 20-200 Day MACD

- Medium Term: 50-Day Moving Average, 50-100 Day MACD, 50-150 Day MACD, 50-200 Day MACD

- Long Term: 100-Day Moving Average, 150 Day Moving Average, 200-Day Moving Average, 100-200 Day MACD

Barchart's Top Picks and Trading Strategies takes this concept one step further. Hypothetically, if a stock's 50-Day Moving Average moves to a New Buy signal, it's price would continue to rise until the signal changes to a New Sell. Our Trading Strategies are designed to calculate hypothetical trading results from each of the 13 different technical indicators. If a new trade were executed when the indicator started a new Buy, and a closing trade was made it reached a new Sell, a profit might be made. Trading Strategies also can be profitable when you open a trade based on a new Sell signal, then close the trade when the signal reaches a new Buy. All Trading Strategies for a symbol can be found on the symbol's Trading Strategies page.

Barchart's Top Stock Pick

The page tells you how many historical trades have been generated by the signal, and how long each trade lasted on average. A chart is shown with the signal, along with the stock's Fundamentals and Profile information. Having this data at hand can be helpful in determining if this Top Pick is something that you may want to follow.

The 5-Year Signal Gain is specific to that symbol and to the signal / action (for example, IBM + a 100-Day Moving Average "Buy"). This represents the 5-year historical percent gain for hypothetical trades made by the signal/action, as tracked on the symbol's Trading Strategies page.

The Top Stock Picks are not a recommendation to buy or sell a security. Your decision whether or not to make a purchase should be based on your own due diligence and not on any representation we make to you.

THESE RESULTS ARE BASED ON SIMULATED OR HYPOTHETICAL PERFORMANCE RESULTS THAT HAVE CERTAIN INHERENT LIMITATIONS. UNLIKE THE RESULTS SHOWN IN AN ACTUAL PERFORMANCE RECORD, THESE RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, BECAUSE THESE TRADES HAVE NOT ACTUALLY BEEN EXECUTED, THESE RESULTS MAY HAVE UNDER-OR OVER-COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED OR HYPOTHETICAL TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THESE BEING SHOWN.